Property and Alternatives

Following a stronger April (+6.4%), the UK Commercial Property sector was back in negative territory last month, with the FTSE EPRA NAREIT UK Index returning -5.9%. Sub-sector performance was mixed, however over 70% of REITs derated throughout the month, challenged again by the headwind of rising yields. Brighter spots included UK Residential which performed well due to Civitas Social Housing’s takeover bid, which was at a 44.4% premium to the company’s closing price on 5th May. Other encouraging corporate activity for the sector included an agreement for an all-share offer of CT Property Trust from LondonMetric, which represented a 34.3% premium to the share price. We see this corporate activity as a positive sign in demonstrating value, in a sector that has recently seen a perfect storm of headwinds.

Rising yields also put pressure on direct infrastructure and renewables trusts, with the sectors returning an average of -3.3% and -3.2% respectively over May. 3i Infrastructure trust held up better following strong results on 10th May and ended the month flat. The trust delivered a 14.7% return throughout the last year, with portfolio companies benefitting from direct contract indexation and strong market positions providing pricing power.

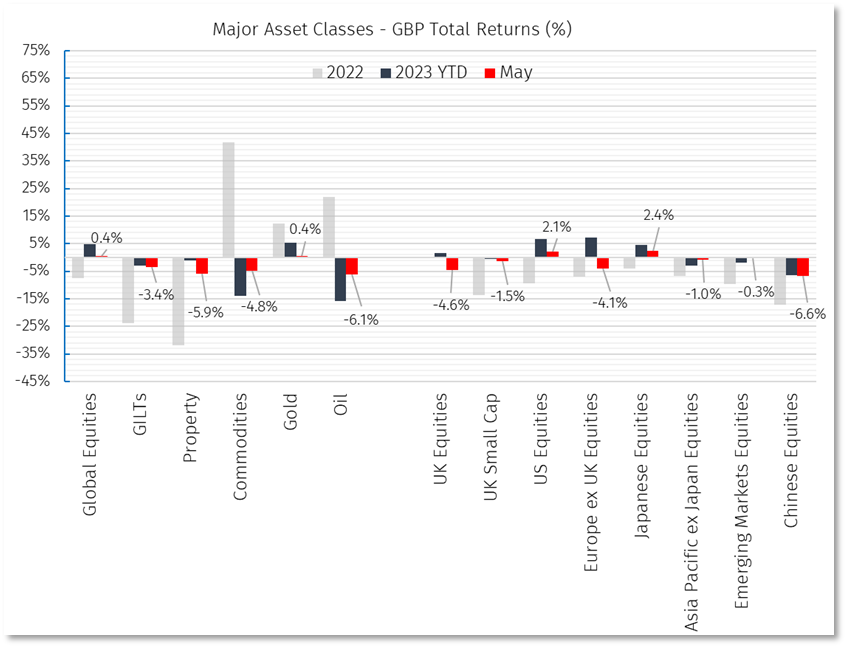

Oil prices fell 6.1% (8.6% in dollar terms) with uncertainty around China demand. The oil price fell back below $70 during the month, a level that had previously provoked an earlier reaction from OPEC+. At the time of writing further cuts have been announced following an OPEC+ meeting on 4th June, with Saudi Arabia cutting oil production by 1mn barrels a day. Industrial metals also suffered from uncertainty about Chinese demand, with copper continuing to detract another 5.2% for the month. Gold broke the $2,000 per ounce psychological barrier again early in May and was close to testing all-time highs but has been in a period of consolidation since then.

The value of investments can fall as well as rise and you might get back less than you invest. Past performance is not a reliable indicator of future performance.